You’re not sure whether to sell your property or keep it as a rental. Both options sound good in theory—but they come with very different risks, timelines, and returns. In this guide, we’ll walk you through exactly how to think about the decision and how to use our free Rent vs Sell Calculator to compare your options using real numbers

What a Rent vs Sell Calculator Actually Compares

A good rent vs sell calculator doesn’t just ask, “How much could I get if I sold?” It compares two different paths:

If you rent the property:

– Monthly cash flow after expenses

– Vacancies and time between tenants

– Maintenance, repairs and capital improvements

– Property tax, insurance, HOA and management fees

– Long-term appreciation potential

If you sell the property:

– Estimated sale price

– Agent commissions and closing costs

– Mortgage payoff

– Estimated net proceeds in your pocket

The goal isn’t to guess the future perfectly—it’s to put both options on the same playing field so you can make a decision based on realistic assumptions, not just gut feeling.

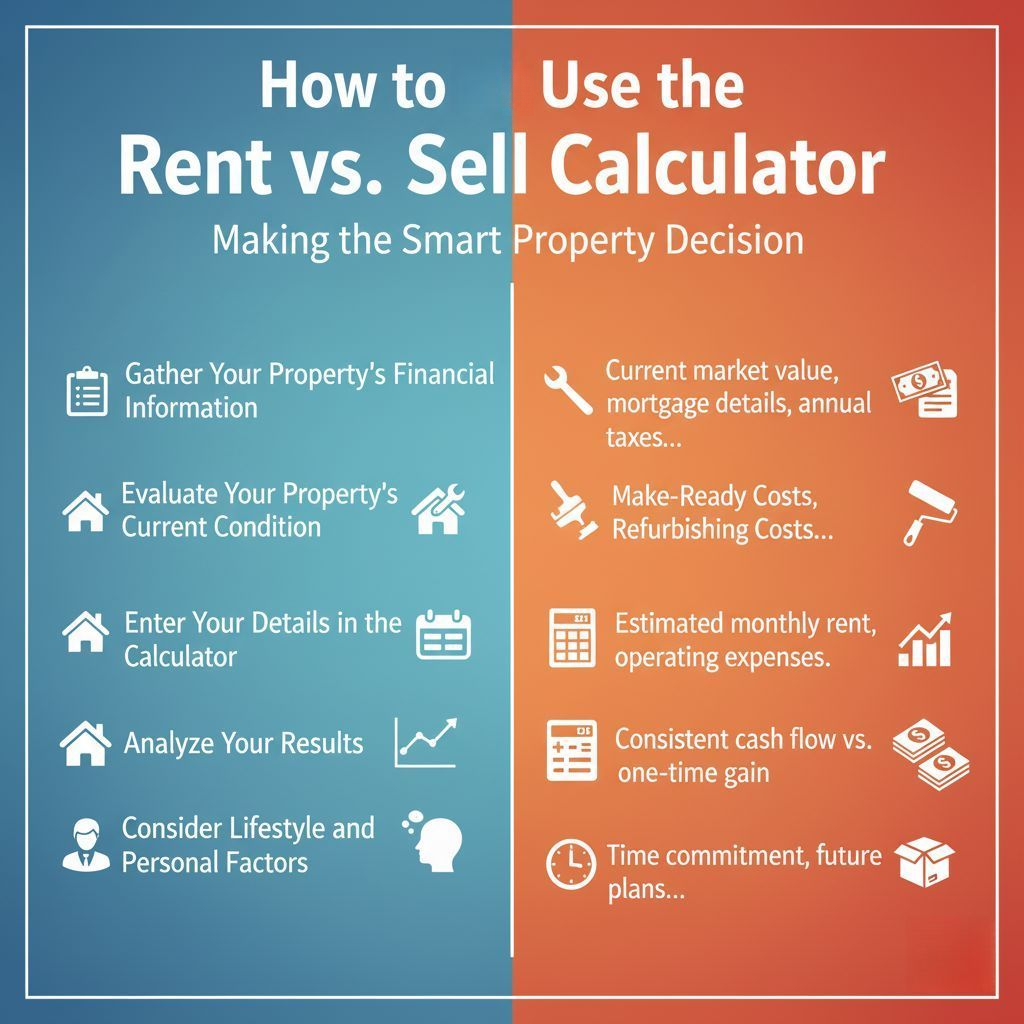

Step 1: Gather Your Numbers Before You Use the Calculator

Before you open the calculator, grab a few key numbers. You don’t need them to be perfect— reasonable estimates are fine:

– Your property’s estimated sale price

– Your remaining mortgage balance and interest rate

– Current or projected monthly rent

– Property taxes, insurance, HOA dues and typical maintenance costs

– How many years you’d realistically hold the property if you keep it as a rental

If your property is in North County San Diego (Carlsbad, Oceanside, Vista, San Marcos, Escondido, etc.), we can help you fine-tune these numbers based on what we’re seeing in the local market.

Step 2: Use the Rent vs Sell Calculator

Once you have your numbers, it’s time to plug them into the tool. Our calculator walks you through:

- Basic property details

- Your rent and expense assumptions

- Your estimated sale price and selling costs

In a couple of minutes, you’ll see a side-by-side comparison of the rent path vs the sell path.

Step 3: How to Interpret Your Rent vs Sell Results

When you see your results, focus on the big picture:

- If renting comes out significantly ahead:

– You may be sitting on a strong long-term rental, especially if you have good cash flow and expect solid appreciation.

– Make sure you’re comfortable with being a landlord or working with a property management company to handle the day-to-day. - If selling comes out ahead:

– You may be better off taking the lump sum, paying off debt, or reallocating into a different investment.

– Consider timing, tax implications and what you’d do with the proceeds. - If the results are close:

– The decision may come down to your risk tolerance, need for liquidity, and how hands-on you want to be.

– This is where talking to someone who understands your local market and your goals becomes really valuable

For properties in San Diego and North County, we can layer in local rent trends, demand patterns and neighborhood nuance that a calculator can’t fully capture on its own.

How This Decision Plays Out in San Diego & North County

In markets like Carlsbad, Oceanside, Vista, San Marcos and Escondido, the rent vs sell decision often isn’t obvious:

– Strong long-term appreciation has historically made holding attractive.

– But high prices and interest rates can make today’s cash flow tighter.

That’s why combining a Rent vs Sell Calculator with local market insight is so important. The numbers tell you what’s likely, and local experience helps you decide what’s wise.